Can Americans Buy Property in Italy: Complete Guide (2025)

Houses on a cliff in Positano, Italy.

Dreaming of a villa in Tuscany or a Milan loft? This guide shows Americans buying property in Italy how to buy property in Italy, step by step.

We’ll cover opening an Italian bank account and finding a real estate agent. Get the scoop on property prices in Italy, property tax, and residency rules to secure your home in Italy.

Eligibility for Buying Property in Italy as a US Citizen

If you are an American, you can buy property in Italy just like any Italian citizen. This is possible because a bilateral reciprocity deal lets you own real estate. This deal means you can buy a house in Italy as easily as Italians can buy a home in Italy back home.

You do not need residency or citizenship to join Italy’s property market. You can browse all properties in Italy: city apartments, countryside villas, or coastal cottages.

The Italian real estate scene welcomes foreign buyers without quotas or special permits. You can search online or work with a trusted real estate agent. They guide you through the buying process and explain property prices in Italy, taxes, and fees.

Your purchase is backed by clear laws. You sign a preliminary contract, make a deposit, and then close the sale. You must open an Italian bank account to pay the final price and fees. A land registry check confirms ownership before you sign the deed.

Whether you plan to make Italy your new home in Italy or hold the property as an investment, the process is simple. While staying in Italy as a US citizen, you enjoy the same rights as locals.

This open system makes Italy one of the most accessible markets in Europe. Ready to explore your dream? Let’s get started with purchasing property in Italy today! No hidden rules. The process of buying a house is clear, fair, and fast.

The Essential First Steps to Purchase Property in Italy

Burano, Venice, Metropolitan City of Venice, Italy.

Before you start your property search, you'll need to complete several administrative requirements. These steps might seem bureaucratic, but they're essential for any real estate transaction in Italy.

Obtain a Codice Fiscale

Getting your Codice Fiscale is step one for any financial step in Italy. It includes opening an Italian bank account to signing contracts or paying property tax. It’s a must-have for any American buying property in Italy.

Think of it as your gateway to buy property in Italy, no Codice Fiscale, no purchase property in Italy. You have two routes. You can get a number at an Italian consulate in the US before you land. Or head to the Agenzia delle Entrate once you arrive in Italy.

Both take just hours and need your passport and proof of address. As a foreigner, you’ll use this for everything. This includes getting mortgages, buying a house in Italy, or sealing deals on properties in Italy.

Secure your Codice Fiscale early, and the rest of your property purchase journey will feel like a breeze.

Open an Italian Bank Account

To buy property in Italy, you need an Italian bank account to pay taxes, fees, and utilities. Banks prefer local accounts for large deals, especially if you want to purchase property in Italy.

Most Italian banks will ask for your Codice Fiscale and passport. Some even want proof of income or employment, especially if you’re a foreigner. This shows sellers and real estate agents you’re serious. This small step unlocks big rewards.

Before you arrive, explore different banks. Big international banks often have English-speaking staff to help ease the buying process. But local banks can offer better rates on properties in Italy and lower fees.

With your account open, you can pay your deposit, final price, and future bills. Your account also ensures essential, smooth property transactions with the land registry and local utilities. It’s your ticket to owning your home in Italy.

Prove Your Identity and Funds

A passport and visa application form.

Ready to buy property in Italy? Keep your valid US passport handy. It’s your go-to ID from start to finish.

Lenders or real estate agents will also want proof of income or assets. This is also necessary if you plan to purchase property with a mortgage. Gather bank statements, employment letters, or investment portfolios to prove your financial capacity.

Some sellers may ask for extra paperwork to verify that you can close the deal. This due diligence protects everyone and helps the buying process flow smoothly.

To avoid hiccups with Italian banks or at the land registry, get key documents translated by a certified translator. Whether you’re eyeing villas or apartments, checking that properties in Italy meet local rules is key. Soon you’ll be enjoying your home in Italy!

Understanding the Buying Process for Your Italian Property

Italy’s property purchase rules are clear. They protect both buyers and sellers. Understanding each step helps you navigate the system confidently and avoid common mistakes.

Step 1: Making an Offer and Signing the Preliminary Contract

Once you spot the perfect properties in Italy, it’s time to make your move. Start by submitting a proposta d’acquisto, a written offer that lays out your price. It also states any conditions for buying a house in Italy.

When the seller accepts, you’ll sign the contratto preliminare. This is a binding preliminary contract that sets your purchase timeline and locks in your commitment. You’ll need to pay a deposit of 10–20% of the purchase price to show you’re serious.

This secures your home in Italy and starts the purchase property process.

Make sure your contract covers all details. These details include property description, price, completion date, and any special conditions. Then, review it with a local lawyer. Use a real estate agent to guide you through this phase.

Italian banks often require proof of an Italian bank account before releasing mortgage funds. So, try to open your account early. You usually have 30–90 days to wrap up due diligence and arrange financing.

Inspect the property, compare property prices, and finalize details before moving ahead.

Step 2: Due Diligence and Engaging a Notary

Alberobello, Metropolitan City of Bari, Italy.

When you buy property in Italy, you first hire a notary (notaio). This public official verifies the title and makes sure the properties in Italy follow local rules. Unlike in the US, notaries are legal professionals trained in Italian real estate.

Next, the notary digs into the land registry, verifies building permits, and confirms all taxes are paid. They protect you during the property purchase process. As a foreigner, knowing these steps helps you buy a house in Italy with confidence.

Still, you’ll want extra help. A lawyer can guard your interests and explain complex Italian property law. A surveyor (geometra) inspects the structure and spots any unregistered renovations.

This due diligence step reveals issues. Some of these issues include unpermitted additions, boundary disputes, or hidden debts. Plus, you need to deal with these issues before you’re locked into a home in Italy.

Finding problems early lets you renegotiate the price or walk away. Sure, professional fees run about 1–3% of the purchase price. However, they can save big headaches (and money) later.

Step 3: The Final Deed and Registration

Time to sign the deed! At the notary’s office, you’ll transfer funds and finalize your purchase of property in Italy. Bring certified bank drafts or arrange a wire from your Italian bank account, as cash limits apply. Don’t forget to bring your ID and purchase agreement.

Once you sign, the notary registers your Italian property with the land registry, making you the official owner. Registration takes several weeks to complete fully.

However, your home in Italy is yours the moment you sign. You’ll also pay property tax and fees, so have your balance ready.

The notary hands over certified copies for your records. Then grab an espresso with your real estate agent to toast! Congratulations, you’ve finished the process of buying a house in Italy! Now you can settle in and enjoy owning property as a foreigner.

Decoding Italian Property Prices and Associated Costs

Learn about Italy’s real estate market. It will help you make smart choices and plan your budget. Property prices vary dramatically between regions, cities, and neighborhoods.

Average Property Prices in Italy

The Italian countryside.

Buying a home in Italy is easier than you think. Italy’s real estate market grew about 2% from 2024 to 2025, keeping things safe and steady. As a foreigner, you can explore a variety of properties in Italy. This could be from city lofts to rural farmhouses.

Across the country, an average 2,000‑square‑foot home in Italy costs around €380,000. However, numbers vary by region. In Milan, prices soar to €5,456 per square meter, with Rome close behind. Meanwhile, Palermo averages just €1,469 per square meter.

These differences make it possible to buy property in Italy on any budget. You could buy a house in Italy near the coast or tucked into the hills. Options exist above and below the average.

Tourist areas and big cities tend to push property prices in Italy higher, while southern regions stay steady.

When you buy a property in Italy, remember to open an Italian bank account. Try to work with a local real estate agent.

Italian banks often provide mortgages to non‑EU buyers, but rates and rules vary. They’ll guide you through the purchase and local taxes so you can enjoy your Italian dream.

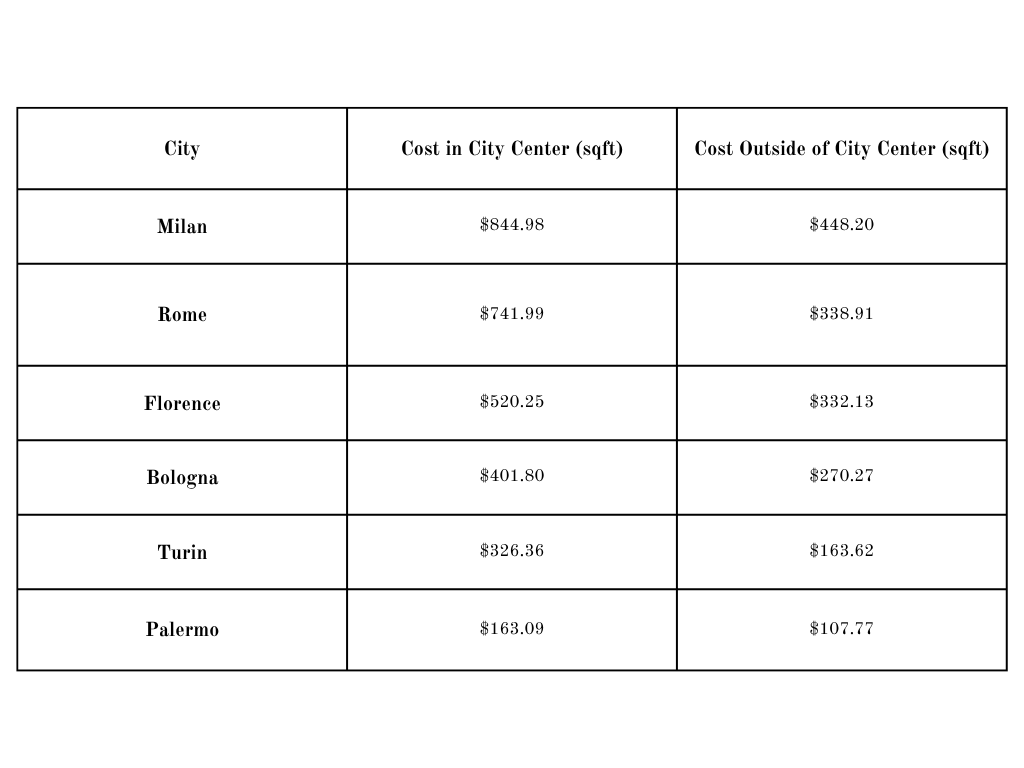

Comparison Table of Property Prices (USD per sqft)

Source: Numbeo, April 2023 data

An Overview of Property Tax and Closing Costs for Foreign Property Buyers

If you want to buy a property in Italy as a foreigner, plan for closing costs of 7–10% of the purchase price. Depending on the deal, fees can climb higher. Early budgeting stops surprises. These fees cover everything from taxes to professional services.

The Registration Tax (Imposta di Registro) kicks in next. You’ll pay 2% of the cadastral value for a primary home or 9% for a second home. The cadastral value is usually lower than the sale price.

When you buy real estate in Italy, new buildings swap registration tax for VAT (IVA). That ranges from 4% to 22% based on the property type and your residency.

Notary fees run about 1–2% of the purchase price. It covers title searches, contract prep, and legal checks. You can open an Italian bank account to streamline financial transactions in Italy. It also helps you pay notary and registry fees quickly.

Estate agents usually charge 3–5% commission plus 22% VAT. In some regions, the fees are split between buyer and seller. Fixed Land Registry and Mortgage Tax fees are €50 each.

Surveyors and translators keep you compliant with local rules. You’ll also budget for survey, legal, and translation costs. Wire transfers can add several hundred euros.

These property taxes and closing charges help you tap Italy’s top real estate market. With clear costs, you can live in Italy worry‑free.

Best Places to Buy Real Estate in Italy

Houses on either side of a canal in Burano, Venice.

Italy offers diverse regions catering to different lifestyles, budgets, and investment goals. Understanding each area's unique characteristics helps you choose the perfect location for your Italian property purchase.

For Culture & History

Closing costs usually run 7–10% of your property purchase, though specifics can vary. The registration tax (Imposta di Registro) sits at 2% of the cadastral value for a primary home.

If you’re purchasing a property, VAT (IVA) replaces the registration tax. Rates range from 4–22%, based on property type and your residency status.

Notary fees add about 1–2% for legal checks and registrations. Expect estate agent commissions of 3–5% plus 22% VAT, often split in regions. Fixed fees for land registry and mortgage tax are €50 each.

Don’t forget to open an Italian bank account early to handle wire transfers and surveyor or translation fees. This clear view of closing costs helps foreign property buyers plan ahead.

For Business & Luxury

Milan serves as Italy’s financial hub and shines in the Italian real estate market. It offers top-notch infrastructure and a smooth buying process in Italy. It is also the country’s highest rental yields on residential properties.

Lake Como sits amidst stunning scenery and luxury villa property options. Celebrity demand keeps property values high. The house prices also reflect its exclusive charm, making real estate in Italy a pricey bet.

For Affordability

Southern Italy, like Sicily, Calabria, and Abruzzo, delivers authentic Italian culture. Southern Italy offers a much lower cost of living in Italy. You’ll find places to buy property for a fraction of northern prices.

Sicily blends rich history and stunning coastlines, while cities like Palermo offer urban perks on a budget. Remember to check the local job market if you plan to stay in Italy or work in Italy.

For a Balanced Lifestyle

Bologna and Turin blend lively culture with wallet-friendly charm. In these cities in Italy, you’ll find top universities, arts scenes, and jobs, without Rome’s sky-high rents.

Bologna’s central spot cuts travel time, while Turin’s Alps backdrop and tech hubs impress. Whether you purchase a property in Italy or rent, partnering with an agent in Italy makes it easier. You’ll be able to understand that property prices in Italy vary.

Navigating Residency and Visas After Buying a House in Italy

Houses in Assisi, Italy.

Buying a house in Italy doesn’t give you residency by default. In Italy, as an American buyer, you can stay up to 90 days in any 180‑day period without a visa. This works well if you own a vacation home and only visit now and then.

To move to Italy long‑term, you’ll apply at your local Italian consulate for the right visa. Owning a home in Italy helps your case, but it won’t guarantee approval. Use your property ownership documents as supporting proof when you apply.

The Elective Residency Visa is ideal for those with stable income from outside Italy. You must show at least €31,000 per year and have health insurance. This visa lets you reside in Italy full‑time but prohibits you from working.

After five years of legal residency, you can seek an EU long‑term permit. Ten years in Italy opens the door to becoming an Italian citizen. Citizenship lets you live and work anywhere in the EU.

If your dream is to buy land in Italy or a second home, plan ahead. Check that your new address complies with local rules and tax rates. For complex property transactions, talk to an immigration lawyer.

They’ll guide you on the cost of living, visa timelines, and the best places to buy. With the right help, you can turn your new Italian property into your forever retreat.

The Pros and Cons of Buying Property in Italy

Think about the pros and cons. This will help you decide if Italian real estate is right for you. Consider both the investment potential and lifestyle implications.

Pros: Investment Potential and Lifestyle

Italy’s real estate market boasts a steady 1.02% CAGR from 2024 to 2029, showing stability over volatility. Italy offers choices from urban flats to rural villas.

In 2023, residential properties in Milan delivered 8.8% gross rental returns. This proves a strong income potential.

It also ranks as the top spot for North Americans seeking a second home in Italy. This is thanks to the value of the property and cultural richness.

The cost of land in Italy remains reasonable compared to other Western European nations. A property purchase in Italy grants access to excellent healthcare. You’ll also have access to education and infrastructure at modest costs.

Its central Mediterranean location makes it simple to travel across Europe for a weekend getaway. This blend of lifestyle perks and affordability makes Italy an attractive option for investors and retirees alike.

Starting the purchase is simple when you follow a clear guide to buying property. Thanks to the reciprocity agreement between Italy, foreign buyers face fewer hurdles.

Even if you’re abroad, you can easily purchase property in Italy through local experts. Plus, the main property tax rates are competitive, keeping costs low.

Cons: Potential Pitfalls When Buying a Home in Italy

A street in Tuscany, Italy.

Buying and selling in Italy can feel slow and tricky. Bureaucratic hoops through the Italian consulate and local offices often test your patience.

Early in your property search, hire a lawyer or agent who knows the ropes. Your range of property choices can be tempting. It could range from quaint farmhouses to city apartments. But each type of property has its own hidden fees.

Don’t skip inspections. Unregistered renovations can lead to huge bills. If you’re not in Italy when making the purchase, you miss hidden issues. Historic homes need special permits and rules. Make sure the property complies with local building codes.

Renovation budgets often skyrocket, and timelines slip. Even many Americans and other foreigners find the process of buying property tougher than expected.

Tourist hubs like Florence and the Amalfi Coast sit among the expensive places to buy property. So expect higher taxes and fees.

Rising market prices mean pricey deals in popular spots. This means that you need to think twice before picking one of the best places to buy. Despite the beauty of Italy, these are the main cons of buying a home.

The Famous 1 Euro Houses: What Foreigners Need to Know

Ever dreamt of owning property in Italy for just €1? The famous 1 Euro Houses offer that chance, but it’s more than a bargain and a big commitment.

Small towns hand over dilapidated homes for a symbolic price to fight depopulation. Buyers of all backgrounds, including US citizens, can buy property. However, you must have detailed renovation plans ready.

Most towns set a three-year deadline to finish work. Miss that date, and you face penalties or lose your new home.

Upfront costs include a security deposit, often €5,000, plus notary fees and full reno bills. Renovation costs often top €50,000, depending on condition and your style.

Each village writes its own rules, so research well and visit in person. Chat with the Italian consulate if you need visa help. Think about owning a home abroad. You'll have to jump through permit hoops, get multiple inspections, and hire local pros.

A good local type of property pro can guide you through local codes.

This is a hands-on way to live la dolce vita. But remember: a cheap sticker price doesn’t cover years of hard work. Ensure that the property suits your budget and lifestyle. Done right, you’ll join a trend of global Italian homeowners in Europe.

US Tax Considerations for Your Italian Property

Residential houses in Chiavari, Metropolitan City of Genoa, Italy.

US citizens face worldwide income taxation no matter where they live or what property they own. Understanding your tax obligations prevents costly mistakes. It also ensures you comply with both IRS rules and Italian law.

You must report rental income from your Italian property on your US federal tax return. This applies even if you reinvest earnings or leave funds in Italian bank accounts.

The US and Italy share a double taxation treaty to prevent you from paying taxes twice. Instead, you can claim a foreign tax credit for taxes paid in Italy.

If you sell within five years, Italy imposes capital gains tax on the sale. Hold the property longer, and this tax usually fades, making longer-term ownership more tax-efficient.

Annual property taxes still apply whether you live there or not. These ongoing costs should factor into your budget before you decide.

Foreign bank account reporting rules (FBAR and FATCA) kick in once your overseas accounts hit set thresholds. Penalties for non‑compliance can be severe, so accurate reporting is essential.

For complex cases, like buying and selling, choosing among a range of properties, or owning property in Italy, contact your tax advisor. They’ll help minimize your US tax bill while you enjoy travel to Italy and life abroad.

Conclusion

Buying property in Italy as an American is achievable thanks to favorable laws and a stable market. Success depends on careful planning, professional guidance, and understanding the complete process from Codice Fiscale to final registration.

Owning a home in Italy is easier than you think. Foreign citizens can buy property thanks to stable laws and a friendly market. With clear steps from Codice Fiscale to registration, Italy for foreigners offers smooth paths. Plan well and ensure that the property fits your needs.

Frequently Asked Questions

What are the pitfalls of buying property in Italy?

Common pitfalls include unregistered renovations and underestimated renovation costs. You’ll also have to deal with bureaucratic delays and language barriers.

Hidden structural issues and complex building regulations can create unexpected expenses. Always conduct thorough due diligence and hire qualified local professionals.

How long can I stay in Italy if I buy a property there?

Property ownership doesn't affect visa requirements. US citizens can stay 90 days per 180-day period without a visa. For longer stays, you need appropriate visas like the Elective Residence Visa. This visa requires property ownership and sufficient income.

Can an American move to Italy if they buy property?

Property ownership supports but doesn't guarantee residency rights. Americans must still obtain proper visas for extended stays.

The Elective Residence Visa allows financially self-sufficient property owners to live in Italy without working. In contrast, other visa types may permit employment.