How to Buy Property in Europe from the US: A Step-by-Step 2025 Guide

Wondering how to buy property in Europe from the US? This guide is designed to simplify the process. We’ll cover essential steps: understanding legal requirements, researching the market, choosing the right country, arranging financing, and avoiding common mistakes. By the end, you’ll have the knowledge to confidently navigate buying property in Europe from the US.

Key Takeaways

Americans can buy property in Europe, but regulations vary by country; research local laws to understand the requirements and potential permits needed.

Understanding market trends is vital; use platforms like SOBA to get insights into property prices and opportunities across different countries.

Legal guidance is crucial throughout the purchasing process; hiring knowledgeable professionals can help you navigate legal requirements and avoid common pitfalls.

Can Americans Buy Property in Europe?

Yes, Americans can buy property in Europe. However, the path to purchasing real estate isn’t uniform across the continent. Each European country has its own set of rules and regulations that govern property purchases by foreigners. These regulations often apply specifically to residential property, impacting residency applications and tax obligations. Some countries, like Portugal and Cyprus, welcome foreign investment with open arms and have few restrictions on property purchases, while others, such as Denmark and Austria, impose more stringent requirements.

In some countries, additional permits may be required to buy land in specific areas. For instance:

In France, purchasing land in military zones requires special permits.

In Hungary, approval from local authorities is mandatory before foreign buyers can acquire property.

In Poland, similar regulations apply.

These regulatory nuances can significantly impact your buying process, making it essential to understand the local laws before proceeding.

Despite these complexities, the legal landscape in Europe offers many opportunities for American buyers. Countries like Cyprus and Portugal are particularly accessible, with straightforward processes for foreign property purchases. Even in countries with more rigorous requirements, thorough research and the right legal guidance can help you navigate the system effectively.

Researching the European Real Estate Market

Understanding the European real estate market is crucial before diving into a property purchase. Each European country has its own real estate laws, regulations, and pricing structures. For example, while the overall house price increase in the European Union was a modest 0.2% in 2023, individual markets like Athens saw significant gains, driven by programs like the Golden Visa which spurred a 12% increase in property prices.

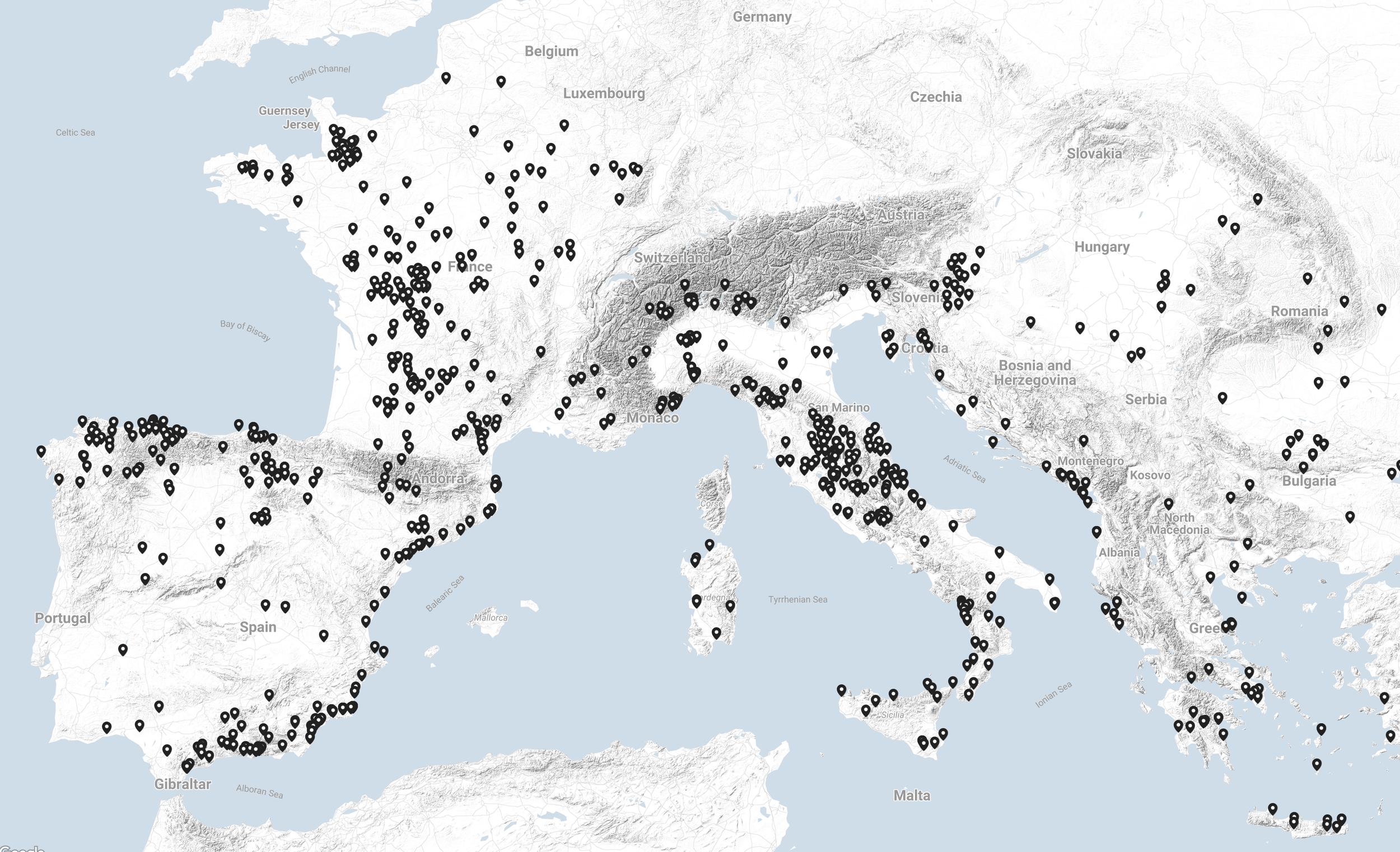

SOBA stands out as an invaluable resource for Americans looking to buy property in Europe, offering comprehensive insights into property prices and market trends across various countries. While SOBA provides an extensive overview, platforms like Rightmove Overseas, Idealista, and Kyero also offer valuable listings that can enhance your understanding of the European real estate market. Take Athens, for example. Despite recent price increases, it remains an attractive market due to its relatively lower prices compared to other major European cities.

Keeping an eye on market trends and understanding the local economy are vital steps in your research. For instance, Portugal’s real estate market is known for its attractive residential and commercial opportunities. Commercial properties, in particular, are appealing to foreign investors as they can be part of Golden Visa programs, with specific minimum investment thresholds varying by country. Staying informed helps in making smarter real estate investments and identifying the best opportunities.

Market Trends and Demand in European Countries

The European property market is currently experiencing a surge in demand, driven by favorable economic conditions and historically low interest rates. Many European countries are witnessing a rise in property prices, with some areas experiencing significant growth. For instance, regions like Abruzzo in Italy and Istria in Croatia are seeing higher demand, partly due to their picturesque landscapes and relatively affordable property prices.

The demand for energy-efficient homes is also on the rise, influenced by the European Union’s stringent green building regulations. These regulations are pushing both developers and buyers to prioritize sustainability, making energy-efficient properties highly sought after.

The COVID-19 pandemic has led to notable shifts in housing demand. Many families are now seeking homes in smaller towns and rural areas, away from crowded urban centers. This trend is particularly evident in Southern Europe, where the appeal of a quieter, more spacious living environment is drawing buyers.

The strength of the US dollar against the euro is another factor benefiting American buyers. This favorable exchange rate makes European properties more affordable, allowing buyers to get more value for their money. Coastal properties continue to attract significant interest, although beachfront locations often come with higher prices and property taxes.

Interestingly, some of Europe’s best-kept secrets, such as Poland, Hungary, and Slovenia, are witnessing significant price increases. These countries offer a blend of cultural richness, natural beauty, and competitive property prices, making them attractive options for real estate investors.

European Union Regulations and Restrictions

When it comes to purchasing property in Europe, the European Union (EU) has implemented various regulations and restrictions that foreign buyers need to be aware of. Non-EU citizens, in particular, may face specific challenges and requirements.

In several EU countries, foreign buyers are required to obtain a permit or license before they can purchase property. This is to ensure that the investment complies with local laws and regulations. For example, in some regions, there are restrictions on buying agricultural land or properties in certain strategic areas.

The EU’s Anti-Money Laundering Directive mandates that real estate agents and other professionals conduct thorough due diligence on buyers. This includes verifying the source of funds to prevent money laundering and other illegal activities. Additionally, the General Data Protection Regulation (GDPR) applies to the processing of personal data in real estate transactions, ensuring that buyers’ information is handled securely and transparently.

The Capital Requirements Directive (CRD) and the Mortgage Credit Directive (MCD) regulate the financing of real estate purchases and mortgage lending, respectively. These directives aim to protect consumers and ensure that financial institutions operate responsibly. The Alternative Investment Fund Managers Directive (AIFMD) also plays a role by regulating the management of alternative investment funds, including real estate funds.

Understanding these regulations is crucial for foreign buyers to navigate the complexities of purchasing property in the European Union effectively.

Choosing the Right European Country

Choosing the right country for your property purchase is crucial. Factors such as lifestyle preferences, climate, amenities, and cultural opportunities play a significant role in this choice. Portugal stands out as one of the most accessible European countries for Americans looking to purchase real estate. Its welcoming policies and vibrant culture make it a top choice.

Other countries like France and Cyprus also offer favorable markets for property investments. Spain is another popular destination, especially areas like Costa Del Sol, Costa Blanca, Madrid, and Barcelona, which are well-loved by American buyers. Greece has become increasingly appealing due to its Golden Visa program, which allows for investments starting from €250,000.

Considering the cost of living and the local real estate market is also essential. While cities like London offer a well-connected infrastructure and vibrant cultural scene, the high cost of living might be a deterrent. On the other hand, cities like Valencia in Spain offer competitive real estate markets and are expected to see rising property values due to their cultural and economic significance.

Popular European Countries for American Buyers

Several European countries have become popular destinations for American property buyers, each offering unique attractions and benefits.

Spain is a top choice, particularly cities like Madrid and Barcelona, known for their vibrant culture, excellent infrastructure, and appealing real estate markets. The coastal regions, such as Costa del Sol and Costa Blanca, are also highly sought after for their beautiful beaches and sunny climate.

Portugal is another favorite, especially the Algarve region, which boasts stunning coastlines, a relaxed lifestyle, and favorable property prices. Lisbon and Porto are also popular for their rich history and modern amenities.

Italy attracts many American buyers, particularly in regions like Tuscany and Umbria, known for their picturesque landscapes and charming villages. The Italian lifestyle, with its emphasis on good food, wine, and culture, is a significant draw.

France remains a perennial favorite, with cities like Paris and regions like Provence offering a blend of sophistication, history, and natural beauty. The French Riviera is also a hotspot for luxury real estate.

Greece is gaining popularity, especially islands like Crete and Santorini, which offer stunning views, rich history, and a relaxed lifestyle. The Golden Visa program also makes Greece an attractive option for those seeking residency through real estate investment.

Ireland appeals to American buyers, particularly in cities like Dublin and rural areas in County Clare, known for their friendly communities and beautiful landscapes.

Malta is a popular destination for its Mediterranean climate, historical sites, and favorable tax regime. Cities like Sliema and Valletta are particularly attractive to foreign buyers.

Cyprus offers a mix of beautiful beaches, a favorable climate, and a strategic location. Cities like Nicosia and Limassol are popular among American buyers for their vibrant expat communities and investment opportunities.

Researching the Country’s Rules and Regulations

Before diving into a property purchase, it’s essential to thoroughly research the specific regulations and requirements of your desired European country. Each country has its own set of laws regarding property ownership, foreign investment, and tax implications.

Start by understanding the local laws and regulations that govern property ownership. This includes any restrictions on foreign property ownership and the process of obtaining necessary permits or licenses. For instance, some countries may have restrictions on buying agricultural land or properties in certain strategic areas.

Tax implications are another critical aspect to consider. Research the local property taxes, including any annual taxes, transfer taxes, and capital gains taxes. Understanding these costs upfront can help you budget more effectively and avoid unexpected expenses.

If you plan to live in the country, research the process of obtaining a residence permit or visa. Some countries offer residency programs, such as the Golden Visa, which provide a pathway to residency through real estate investment.

The local real estate market and current property prices are also crucial factors. Work with local real estate agents and lawyers who can provide insights into market trends and help you navigate the buying process. They can also assist with due diligence, ensuring that the property has a clear title and is free from any legal disputes.

Understanding the local culture and customs is equally important. This includes any specific practices or restrictions related to property ownership and the role of real estate agents and lawyers in the buying process.

Finally, research the process of financing a property purchase in your desired European country. This includes understanding the mortgage options available to foreign buyers and the documentation required for approval.

Legal Requirements for Foreign Buyers

Understanding the legal requirements for foreign buyers is crucial when purchasing real estate in Europe. Each country has its own set of laws regarding property ownership, residence, taxes, and foreign investment regulations. For instance, in Spain, foreign buyers need a tax identification number (NIE) and are required to pay VAT on new builds.

In many countries, legal representatives play a vital role in the property purchase process. They conduct due diligence and verify ownership. Additionally, they check for any debts related to the property. Hiring legal assistance ensures compliance with local laws and can prevent potential legal issues down the line.

Specific permits may also be required. For example, in Malta, foreign buyers need an Acquisition of Immovable Property permit, while in Poland, a special permit from the Polish Ministry is mandatory. These requirements highlight the importance of thorough research and legal guidance to navigate the complexities of foreign property purchases effectively.

Financing Your European Property Purchase

Securing financing for your property purchase in Europe can be a complex process, especially for American buyers unfamiliar with the local mortgage landscape. Understanding the available options and requirements is crucial to ensure a smooth transaction.

Exploring Mortgage Options

When purchasing real estate in Europe, American buyers have several financing options. Many European countries offer mortgages to foreign buyers, but terms and conditions can vary. Local banks may have specific requirements, such as higher down payments or proof of income. It's essential to research and compare different lenders to find the best fit for your needs.

For those interested in buying property in Spain, we have a comprehensive podcast episode that delves into the intricacies of obtaining a mortgage in the country. You can listen to it here.

Benefits of Local Mortgages

Opting for a local mortgage can offer several advantages:

Favorable Interest Rates: European mortgages often come with competitive interest rates, which can be beneficial for long-term investments.

Currency Matching: Financing in the local currency helps mitigate exchange rate risks, ensuring your payments remain stable.

Access to Local Expertise: Local lenders are familiar with the real estate market and can provide valuable insights and guidance.

Considerations for American Buyers

When financing a property purchase in Europe, American buyers should consider the following:

Exchange Rate Fluctuations: Be aware of how currency fluctuations can impact your mortgage payments and overall investment.

Legal and Tax Implications: Consult with legal and financial advisors to understand any tax liabilities or legal requirements associated with foreign property purchases.

Documentation Requirements: Prepare to provide comprehensive documentation, including proof of income, credit history, and property details, to facilitate the mortgage approval process.

By understanding the financing landscape and exploring available options, American buyers can effectively navigate the complexities of purchasing property in Europe.

Understanding Taxes and Fees

When buying property in Europe, it’s essential to understand the various taxes and fees associated with the purchase. These costs can vary significantly from one country to another, so thorough research is crucial.

Start by researching the specific taxes and fees in your desired European country. This includes property transfer taxes, which are typically a percentage of the purchase price. For example, in Spain, the property transfer tax for pre-owned homes ranges from 6% to 10%, depending on the region.

Notary fees are another significant cost. These fees are regulated in many countries and are based on the property’s value. In Spain, notary fees generally fall between 600 to 875 euros. Legal fees, which cover the cost of hiring a lawyer to assist with the transaction, usually range from 1% to 2% of the purchase price.

Stamp duties are also applicable in many countries, typically around 1-1.5% of the property’s price for new property purchases. Additionally, there may be property registration fees, which vary based on the type of property and residency status.

If you plan to rent out your property, research the local tax implications. This includes understanding the income tax rates on rental income and any required licenses or permits for renting out property.

Obtaining a tax identification number is often a necessary step in the property purchase process. This number is required for paying property taxes and other related fees.

When selling a property, be aware of the local tax implications, including capital gains taxes. Some countries offer tax refunds or exemptions under certain conditions, so it’s essential to understand these rules.

Finally, ensure that you have a clear understanding of the process for paying fees and taxes in your desired European country. This includes knowing the deadlines for payments and the methods of payment accepted.

By thoroughly researching and understanding the taxes and fees associated with buying property in Europe, you can budget more effectively and avoid unexpected expenses.

Using Cash-Out Refinance to Buy Property in Europe

One effective strategy for Americans looking to buy property in Europe is to leverage a cash-out refinance on their U.S. home. This financial maneuver allows homeowners to refinance their existing mortgage for more than they currently owe, receiving the difference in cash. By doing so, you can free up funds to purchase real estate in Europe, making the process smoother by positioning yourself as a cash buyer.

Steps to Cash-Out Refinance

Evaluate Your Home's Equity: Determine the amount of equity you have in your U.S. property. Most lenders require that you maintain at least 20% equity after the refinance.

Choose a Lender: Work with a reliable U.S. bank or mortgage lender experienced in cash-out refinances. Compare interest rates and terms to find the best deal.

Application Process: Submit the necessary documentation, including proof of income, credit history, and property appraisal. The lender will assess your financial situation to approve the refinance.

Receive Funds: Once approved, you'll receive the cash difference, which can be used to purchase property in Europe.

Benefits of Cash Buyer Status

Being a cash buyer in the European real estate market offers several advantages:

Stronger Negotiation Position: Sellers often prefer cash buyers as it reduces the risk of financing issues, allowing you to negotiate better terms or a lower purchase price.

Faster Closing Process: Without the need for mortgage approval, the transaction can proceed more quickly, aligning with sellers' timelines.

Reduced Costs: Avoiding foreign mortgage interest rates and fees can result in significant savings.

Considerations

Exchange Rates: Be mindful of currency exchange rates when transferring funds to Europe, as fluctuations can impact the amount you have available for your property purchase.

Legal and Tax Implications: Consult with legal and financial advisors familiar with both U.S. and European regulations to understand any tax liabilities or legal requirements.

By utilizing a cash-out refinance, American buyers can streamline their property purchase in Europe, enjoying a competitive edge in the real estate market.

Finding a Reliable Real Estate Agent

Finding a reliable real estate agent is vital in the property purchase process. Real estate agents can help you navigate the market, negotiate deals, and provide personalized advisory services. They can also assist with filling out necessary forms and ensuring that your interests are represented throughout the buying process.

Researching potential agents through referrals and online platforms is a good starting point. Meeting with potential agents allows you to assess their market knowledge and communication style, which is crucial for a smooth transaction. Understanding an agent’s fee structure upfront can help avoid unexpected costs during the buying process.

An agent experienced with foreign buyers understands the unique challenges in navigating legalities. Checking for timely communication practices is also essential to ensure that you are kept informed at every step of the process.

Conducting Due Diligence

Conducting due diligence ensures your property purchase goes smoothly. This involves conducting property surveys to identify any issues such as mold or electrical problems. Verifying the property’s condition can save you from costly future repairs.

Checking the legal title of the property is crucial. This confirms ownership and helps uncover any disputes or claims against the property. Reviewing property documents and inspecting for zoning regulations are also critical steps, as these regulations can affect future property use.

Making an Offer and Signing Contracts

Making an offer and signing contracts are key milestones in the property purchase process. Offers can be submitted through an agent or directly to the seller, and be prepared for negotiations. In countries like France, making an offer promptly secures the property at the proposed price until the pre-contract is signed.

A realtor can help you make a sensible offer. Different countries have different processes for finalizing a purchase. For instance, in Italy, the process involves signing a Preliminary Agreement, paying a deposit, signing the Final Agreement, and taking ownership. It’s essential to have funds available for the sale and allow time for deposit payments to be processed.

The deposit amount typically ranges from 5–10% of the property’s price when signing a preliminary contract. In the UK, the sale must be completed on the same day. This day is referred to as completion day, and all parties must agree to it. Additionally, a cooling-off period allows buyers to withdraw from the sale without repercussions after making an offer.

Closing the Deal

Closing the deal includes finalizing paperwork, paying taxes, and meeting all financial obligations. In France, the final contract, known as ‘Acte Authentique,’ legally transfers ownership upon completion. The ‘Compromis de Vente’ is a binding contract that outlines purchase details and sets a completion date.

After signing the final contract, buyers typically need to deposit around 10% of the purchase price to the Notaire. Notary fees in Italy can range from 1% to 2.5% of the property’s declared value and are required at the final contract signing.

After the purchase, register ownership with the local land registry and keep all documents.

Potential Residency Benefits

Owning property in Europe may come with potential residency benefits. Many countries offer Golden Visa programs, which provide a path to residency through real estate investment. Portugal’s Golden Visa program, for example, allows non-EU citizens to obtain residency by investing in real estate.

Greece offers a similar program with nine investment options, with real estate being the most common and a minimum investment requirement of €250,000. In Italy, the Golden Visa program includes investment options starting from €250,000 for innovative startups or €500,000 for business investments.

The Cyprus Permanent Residence program mandates a minimum investment in real estate of €300,000 for a lifetime residency option. Participation in these programs often includes expedited residence applications and reduced tax rates. Additionally, Portugal’s Golden Visa allows for a pathway to citizenship after five years and requires only seven days of physical presence per year.

Costs Involved in Buying Property in Europe

Knowing the costs involved in buying property in Europe is essential for budgeting. In Spain, buyers should account for extra costs amounting to 10-12% of the property’s price, including various taxes and fees. The property transfer tax for pre-owned homes typically ranges from 6% to 10% depending on the region.

Notary fees for property transactions in Spain are regulated and generally fall between 600 to 875 euros, depending on the property’s value. Legal fees usually range from 1% to 2% of the purchase price. Additionally, the stamp duty is around 1-1.5% of the property’s price and is applicable on new property purchases.

Buyers should also consider additional mortgage-related costs, which may include property valuation fees ranging between 250 and 600 euros. The property registration tax varies between 3% to 10% based on the type of property and residency status. It’s essential to verify all fees and costs, including property taxes, in writing before signing any preliminary contracts to avoid unexpected expenses.

Managing Your European Property

Efficiently managing your European property is crucial for maintaining its value. This includes keeping organized records of property-related documents throughout the ownership period. Yearly maintenance costs, such as monthly maintenance fees for condominiums, should be budgeted for.

If you plan to rent out your property, consider factors like market saturation, occupancy rates, local rental laws, required licenses, and income tax. Researching local laws is essential to ensure compliance and smooth management of your rental property.

Engaging a professional appraiser can provide an accurate valuation of the commercial property, which is useful for setting rental prices and managing your investment.

Avoiding Common Pitfalls

Avoiding common pitfalls is essential for a successful property purchase. To minimize the risk of scams, inspect the property in person, complete necessary checks, and confirm information before sharing personal data. Working with reputable banks, lawyers, realtors, advisors, mortgage brokers, and real estate investors can help prevent potential scams when purchasing property.

A cautious and thorough approach can prevent common mistakes. Thorough inspections and diligent research will ensure that you make an informed decision and avoid costly errors.

Summary

Embarking on the journey to buy property in Europe from the US is both exciting and challenging. From understanding whether Americans can buy property in Europe to researching the market and choosing the right country, every step is crucial. Legal requirements and financing options need careful consideration to ensure a smooth transaction.

Finding a reliable real estate agent and conducting due diligence are essential to avoid pitfalls. Making an offer and closing the deal involves several steps, but with the right guidance, these can be navigated successfully. The potential residency benefits, including Golden Visa programs, add an extra layer of appeal to purchasing property in Europe.

While costs and management aspects are significant, being well-informed can make the process more manageable. Avoiding common pitfalls through thorough research and professional assistance ensures that your investment is sound. With the right approach, buying property in Europe can be a rewarding endeavor, opening doors to new opportunities and experiences.

Frequently Asked Questions

Can Americans buy property in Europe without any restrictions?

Absolutely, Americans can purchase property in Europe, but keep in mind that the regulations differ from country to country. Some places may have minimal restrictions, while others might ask for permits or approvals.

What are the key platforms for researching European real estate?

To research European real estate, platforms like Rightmove Overseas, Idealista, and Kyero are excellent for exploring properties and market trends. For a more curated experience, consider SOBA, a membership-based home search platform designed for international buyers. SOBA offers hand-picked listings, expert curation, and local insights, simplifying the search for affordable, character-filled homes across Spain, Italy, France, the Balkans, and beyond. With features like regional newsletters and a proprietary home search platform, SOBA stands out by prioritizing charm, value, and lifestyle fit over mere price per square meter, making the search both easy and insightful!

What is the Golden Visa program, and which countries offer it?

The Golden Visa program lets you gain residency through real estate investments, and it's available in countries like Portugal, Greece, and Cyprus, each with its own investment criteria. It's a great opportunity if you're looking to expand your horizons! These programs not only provide a pathway to residency but also offer various benefits such as access to education, healthcare, and the ability to travel freely within the Schengen Zone. In Portugal, for instance, the program requires a minimum investment of €500,000 in real estate, while Greece offers a more accessible option with a minimum investment of €250,000. Cyprus, on the other hand, requires a higher investment threshold, but it provides a fast-track route to permanent residency. These programs are particularly appealing to real estate investors and foreign buyers seeking to diversify their portfolios while enjoying the lifestyle and cultural richness of European countries. Additionally, the Golden Visa programs often come with the possibility of obtaining citizenship after a certain period, making them an attractive option for those looking to establish a long-term presence in Europe. As property prices continue to rise in many European countries, investing in real estate through these programs can also be a sound financial decision, offering potential rental income and capital appreciation. Whether you're interested in residential properties, commercial real estate, or even agricultural land, the Golden Visa programs provide a versatile and rewarding pathway to becoming a part of the European Union community.

What are the typical costs involved in buying property in Europe?

Buying property in Europe typically involves costs like property transfer taxes, notary and legal fees, and stamp duties, which can add up to 10-12% of the property's price in places like Spain. So, be sure to budget for these expenses when making your purchase!

How can I avoid common pitfalls when buying property in Europe?

To steer clear of common pitfalls when buying property in Europe, always inspect the property in person, collaborate with reputable professionals, and conduct thorough due diligence, especially on legal titles and property conditions. Being proactive in these areas can save you from future headaches!