Best Countries to Buy Property in Europe

Looking to invest in property in Europe? Whether you’re seeking a second home, a retirement destination, or a smart real estate investment, the European property markets offer a diverse range of options.

From sun-soaked Mediterranean coastlines to charming Alpine towns, Europe’s diversity makes it one of the most attractive regions for international buyers purchasing real estate. With so many countries offering unique benefits, it’s important to understand what sets each market apart.

In this guide, we break down the best countries for buying a property in Europe—looking at affordability, market trends, lifestyle perks, and residency opportunities to help you make a confident, informed decision.

1. Spain

Why Buy Property in Spain?

Spain attracts buyers with its Mediterranean lifestyle, vast coastline, and cultural richness. It's also one of the top destinations where Americans buy property in Europe, thanks to its well-established expat communities and strong infrastructure.

Whether you're seeking a holiday home or a long-term investment, Spain offers a compelling mix of lifestyle and financial opportunity.

Key Benefits:

Reasonable property prices in many regions

Popular destination for retirees

High rental demand in coastal and urban areas

Top Areas to Consider:

Costa del Sol: Sun-drenched beaches and luxury villas

Barcelona: Cosmopolitan city with gorgeous beaches

Valencia: Affordable alternative to Barcelona with cultural charm

Balearic Islands: Idyllic island lifestyle

2. Italy

Why Buy Property in Italy?

Italy’s timeless beauty and varied landscapes make it a dream destination for property buyers. Whether you're looking for a countryside escape or a city apartment, the country offers a wide range of residential property options. From rolling Tuscan hills to bustling cities and quiet seaside towns, Italy has something for everyone.

Key Benefits:

Wide variety of properties across price ranges

Special tax incentives for foreign residents

1-euro home schemes in rural areas

Rich cultural heritage and cuisine

Top Areas to Consider:

Tuscany: Quintessential countryside with historic villas

Puglia: Affordable and charming with Adriatic beaches

Calabria: Rugged and scenic with unspoiled coastlines

Sicily: Low-cost properties and coastal views

3. Greece

Why Buy Property in Greece?

Greece offers beautiful islands, historical sites, and competitive pricing. Its Golden Visa program is one of the most affordable in Europe, requiring a minimum property investment of just €250,000.

Key Benefits:

Low property prices compared to other European destinations

Attractive Golden Visa program

Booming short-term rental market, especially on islands

Rich history and scenic landscapes

Top Areas to Consider:

Athens: Scenic and with cultural appeal

Crete: Large island with diverse property options

Santorini: High-end property and strong rental demand

Thessaloniki: Up-and-coming city for investment

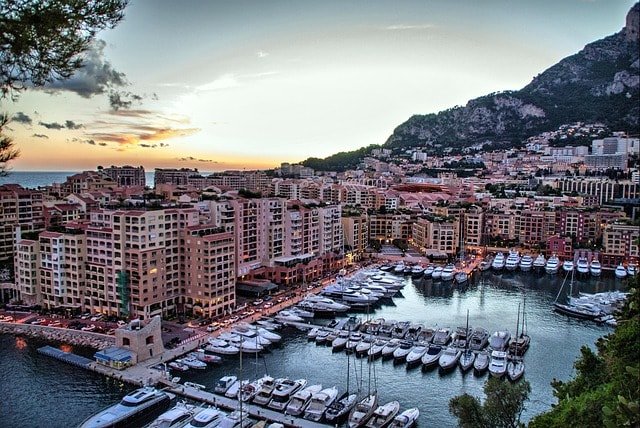

5. France

Why Buy Property in France?

France remains one of the most stable and desirable property markets in Europe. Its diverse regions offer everything from Alpine ski chalets to Riviera villas, plus a high quality of life and excellent healthcare. unique commercial property offerings

Key Benefits:

Strong property laws and buyer protections

Long-term appreciation potential

Variety of landscapes and lifestyles

Large English-speaking communities in certain areas

Top Areas to Consider:

Paris: Prestigious city with strong capital growth

Provence: Mediterranean climate and lavender fields

Dordogne: Popular with expats for its tranquility

French Alps: Ski properties with year-round appeal

7. Croatia

Why Buy Property in Croatia?

Croatia’s Adriatic coast has become a top destination for travelers and investors alike. With UNESCO towns, clear waters, and increasing tourism, it offers high rental potential and lifestyle appeal.

Key Benefits:

Fast-growing tourist market

Coastal charm with relatively low prices for properties

EU member with Schengen access

Natural beauty and historical towns

Top Areas to Consider:

Dubrovnik: Historic town with luxury appeal

Split: Lively coastal city

Istria: Italian-influenced peninsula with scenic beauty

Zagreb: Affordable capital with cultural attractions

8. Montenegro

Why Buy Property in Montenegro?

Montenegro is gaining popularity for its natural beauty and low transfer taxes. Its coastline rivals Croatia’s, but with lower costs and growing luxury developments.

Key Benefits:

Low taxes and business-friendly climate

Up-and-coming tourism sector

Coastal and mountain property variety

Top Areas to Consider:

Kotor Bay: Dramatic scenery and UNESCO status

Budva: Popular seaside resort town

Tivat: Luxury developments and marina lifestyle

Podgorica: Growing capital city

9. Albania

Why Buy Property in Albania?

Albania has rapidly gained attention in recent years for its affordable seaside homes, untouched landscapes, and growing tourism sector. With a low cost of living and property prices well below those of neighboring Mediterranean countries, it’s becoming a top destination for foreign property purchases.

Key Benefits:

Low property prices with high growth potential

Simplified purchase process for foreigners

Coastal cities with increasing rental demand

Warm climate and welcoming local culture

Top Areas to Consider:

Sarandë: A fast-growing coastal town with Ionian Sea views

Vlora: Where the Adriatic meets the Ionian—great for investment

Tirana: Capital city with rising urban development

Durrës: Historic charm and beachfront living

10. Slovenia

Why Buy Property in Slovenia?

Slovenia blends Alpine beauty with Central European charm and a strong, stable economy. It's ideal for buyers and real estate investors seeking a mix of nature, culture, and long-term investment potential. As a member of the EU and Schengen zone, it also offers legal transparency and security for real estate transactions.

Key Benefits:

Stable and growing housing market

High quality of life with excellent infrastructure

Close proximity to Italy, Austria, and Croatia

Outdoor lifestyle: skiing, lakes, and hiking

Top Areas to Consider:

Ljubljana: Compact, vibrant capital with cultural appeal

Lake Bled: Idyllic alpine setting with strong tourist demand

Maribor: Underrated and affordable with skiing potential

Piran: Charming Adriatic coastal town

11. Romania

Why Buy Property in Romania?

Romania is becoming an attractive destination for Americans buying property, thanks to its low cost of living, diverse geography, and rising digital nomad presence. Whether you're interested in a city apartment or a rural getaway, Romania offers excellent value and growth potential.

Key Benefits:

Very affordable real estate market

Growing expat and remote worker community

English widely spoken in urban areas

Unique mix of mountains, cities, and coastline

Top Areas to Consider:

Bucharest: A tech and business hub with urban appeal

Cluj-Napoca: Academic city with a youthful atmosphere

Brașov: Mountain town near ski resorts

Constanța: Black Sea coastal city with investment potential

12. Bulgaria

Why Buy Property in Bulgaria?

Bulgaria offers excellent value for both residential and investment property, with a wide range of affordable homes near beaches, ski resorts, and historic towns. Its EU membership and accessible buying process make it a practical choice for foreign property purchases.

Key Benefits:

Low purchasing property prices and cost of living

Less restrictions on foreign ownership of apartments

Fast-growing rental markets in cities and resorts

Great for both commercial and residential property investment

Top Areas to Consider:

Sofia: Capital city with strong rental and resale demand

Bansko: Top ski destination with affordable homes

Plovdiv: European culture capital with historic charm

Sunny Beach: Budget-friendly resort town on the Black Sea

13. Turkey

Why Buy Property in Turkey?

Turkey offers a unique blend of Eastern and Western influences, along with a competitive property market and favorable residency options. With warm coastal towns, vibrant cities, and a wide range of property types, it's a standout for Americans looking to buy abroad.

Key Benefits:

Citizenship by investment available at competitive rates

Affordable seaside and urban real estate

High rental yields in tourist-friendly areas

Established expat communities and investor-friendly policies

Top Areas to Consider:

Istanbul: Bustling metropolis with global investment appeal

Antalya: Coastal hotspot with beaches and ancient ruins

Bodrum: Luxury lifestyle with resort-town vibes

Fethiye: Laid-back, scenic town with good value homes

Tips for Buying Property in Europe

1. Understand Residency Requirements

Each country has its own set of regulations when it comes to non-EU buyers, and those rules can significantly impact your ability to purchase and live in the property long-term. Before making any commitments, take time to thoroughly research visa and residency programs, including whether real estate investment qualifies you for a residency permit or long-stay visa.

Understanding these legal requirements in advance can help you avoid unexpected hurdles and ensure your purchase supports your long-term plans.

2. Work with Local Experts

Hiring local real estate agents and legal professionals is essential when purchasing property abroad, especially in countries where language barriers and unfamiliar legal systems can complicate the process.

A licensed real estate agent with experience in working with foreign buyers can help you identify properties that meet your goals, negotiate prices, and understand regional market trends. For instance, in France and Italy, agents can also advise on renovation opportunities and rental potential, which is helpful if you're looking for investment income.

Equally important is securing a qualified local attorney or notary who understands the property laws and tax implications specific to that country.

In places like Spain, for example, legal professionals ensure that there are no outstanding debts on the property and that the title is clear before proceeding with the sale. They can also guide you through contracts, assist with obtaining a tax identification number, and help set up a local bank account if required.

Together, a reliable agent and legal expert can make the entire process of buying a home in Europe much smoother, ensuring that all real estate transactions are fully compliant with the country's laws while keeping your interests in mind.

3. Factor in Additional Costs

When planning to buy property in Europe, it’s important to budget well beyond the listing price. In addition to the cost of the home itself, you’ll need to account for several other expenses—some of which can vary significantly by country.

Common costs include property transfer taxes, notary fees, legal fees, and potential renovation or maintenance expenses.

Take for instance, France. Individuals who decide to purchase a home will usually set aside 7% to 8% of the property's purchase price for taxes and fees, including notary and registration costs.

In Spain, the property transfer tax alone can range from 6% to 10%, depending on the region, and legal fees usually add another 1% to 2%. If you’re purchasing a newly built property, there may also be VAT (value-added tax) to consider.

Legal fees cover the cost of reviewing contracts, conducting due diligence on the title and ownership, and ensuring compliance with local laws—critical services when navigating foreign property purchases.

Notary fees, which are mandatory in many European countries, cover the cost of certifying the real estate transaction and officially registering it with the government. In countries like Italy, the notary plays a central role in the transaction process.

Additionally, be prepared for potential renovation costs, especially if you’re buying an older or rural property. While a fixer-upper in the Balkan countryside might come with a low purchase price, upgrades to meet modern standards—such as plumbing, insulation, or roof repairs—can add up quickly.

Similarly, properties in Greece may require updates for rental licensing or to increase resale value.

By accounting for all of these costs in advance, you'll avoid financial surprises and be better prepared to make a smart, stress-free investment.

4. Visit Before You Buy

Photos can be deceiving, especially when viewing properties online from abroad. A beautifully staged listing might not reveal issues like noise levels, poor natural light, nearby construction, plumbing issues or neighborhood decline.

That’s why it’s crucial to visit the property in person whenever possible—not just to inspect the home itself, but also to get a feel for the surrounding area.

Spending time in the neighborhood allows you to assess things like safety, local amenities, walkability, and the overall vibe—details that rarely come across in listings. Even small factors like parking availability or proximity to public transport can significantly affect your experience and the property’s future value.

Here are a few tips to help make the most of your visit:

✔️ Walk the neighborhood at different times of day — Morning, afternoon, and evening can each reveal different things, like noise levels or street activity.

✔️ Chat with locals or other expats — They can give you honest insights about the area that you won’t find in brochures.

✔️ Check nearby infrastructure — Is there a grocery store, hospital, or school nearby? How accessible is public transport?

✔️ Look beyond the listing photos — Pay attention to signs of moisture, outdated wiring, or needed repairs that might be hidden in pictures.

✔️ Explore the property's surroundings — Are there bars or clubs nearby that could get noisy? Are you near a scenic area or a busy highway?

Visiting in person gives you confidence that you're making a smart decision—not just buying a property, but choosing a place that fits your goals and lifestyle.

5. Consider Long-Term Goals

Take time to think through your long-term plans—whether you're aiming for steady rental income, a future retirement home, transforming agricultural land for commercial purposes or a full relocation—before committing to any property purchase.

Understanding your goals early will help guide where and what you should buy, and ensure your investment aligns with your lifestyle and financial strategy.

Conclusion

Europe offers an impressive mix of lifestyle, history, and investment opportunities when it comes to real estate. Whether you're after sun-drenched beaches in Spain, historic cities in Italy, countryside escapes in France or modern urban hubs in the Balkans, there's a European country perfect for your property goals. By understanding local markets, legal frameworks, and investment potential, you can make a smart and rewarding choice.

With careful research and the right support, buying property in Europe can be a smooth and profitable experience.

FAQ

Can Americans legally buy property in Europe?

Yes, U.S. citizens can legally purchase property in most European countries. However, regulations vary by country. Some nations may have restrictions on land ownership or require special permits for non-EU citizens. It's essential to research the specific laws of the country you're interested in.

Which European countries are most popular for American property buyers?

Countries like Spain, France, Italy, and Greece remain top choices for American buyers, thanks to their sunny climates, vibrant cultures, and comparatively affordable property prices. These destinations also tend to offer attractive opportunities within the European housing market for foreign property investors.

What is the process of buying a home in Europe as a foreigner?

In Europe, buying property usually involves the following steps:

Hiring a reliable real estate agent familiar with foreign property purchases.

Securing legal representation to navigate local laws.

Obtaining a tax identification number in the country.

Opening a local bank account.

Signing a preliminary contract and paying a deposit.

Completing due diligence and finalizing the sale through a notary.

Are there any taxes or fees associated with purchasing property in Europe?

Yes, buyers should anticipate additional costs such as:

Property transfer taxes (vary by country).

Notary and legal fees.

Registration fees.

Ongoing property taxes and maintenance costs.

Can buying property in Europe grant me residency or citizenship?

In some countries, purchasing property above a certain value can qualify you for residency or even citizenship. For example, Greece's Golden Visa program offers residency to those investing a minimum amount in real estate. However, these programs have specific requirements and are subject to change.

Is financing available for foreign buyers in Europe?

Financing options vary by country and lender. Some European banks offer mortgages to non-residents, often requiring a substantial down payment (typically 30-50%) and proof of income. Interest rates and terms may differ from those available to local residents.

What are the risks of foreign property purchases?

Risks include:

Fluctuating exchange rates.

Changes in local laws affecting foreign ownership.

Potential difficulties in property management from abroad.

Market volatility impacting property values.

Conducting thorough due diligence and consulting with local experts can mitigate these risks.

How do I find a reliable real estate agent in Europe?

Seek recommendations from other expatriates or online forums. Ensure the agent is licensed and has experience working with international clients. Professional associations or consulates may also provide referrals to reputable agents.

Are there restrictions on renting out my European property?

Rental regulations vary widely across Europe. Some cities have strict rules on short-term rentals, requiring licenses or limiting rental days per year. It's crucial to understand local laws to ensure compliance and avoid penalties.

How do property prices in Europe compare to those in the U.S.?

Property prices in Europe can be more affordable than in major U.S. cities, especially in rural areas or smaller towns. However, prices vary significantly by location. For instance, urban centers like Paris or London are among the most expensive markets globally.